As of the third quarter of 2023, EPM Group obtained results of COP 3.4 billion, with growth of 11% compared to the same period of 2022.

- Fecha de publicación

- 2023-11-03 00:00

- Titulo

- As of the third quarter of 2023, EPM Group obtained results of COP 3.4 billion, with growth of 11% compared to the same period of 2022.

- Contenido

-

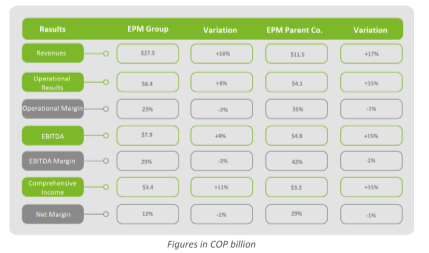

- EPM parent company reported earnings of COP 3.3 billion, up 15% from the same quarter the previous year

- The District of Medellín has received transfers of COP 1.4 billion as of September this year, a contribution to the community's wellbeing

- The EPM Group generated added value to its stakeholders for COP 12.6 billion, with a growth of 11% compared to the same quarter of 2022.

- During the three quarters of the year, the group's investments amounted to COP 3.3 billion, 4% higher than in the same period of 2022.

EPM Group obtained a net result of COP 3.4 billion in the third quarter of 2023, with a growth of 11% compared to the same period of the previous year, a result associated with the provision of public aqueduct, wastewater, generation, transmission and distribution of energy, gas, and solid waste services, in its purpose of contributing to the well-being of the community and the development of the territories where it operates.

As of September this year, EPM parent company has paid surpluses to the District of Medellín of COP 1.4 billion, important resources for social and infrastructure investment.

Financial results of EPM Group and EPM parent company as of September 2023:

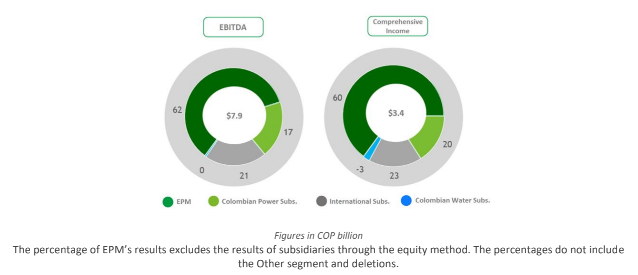

Percentage contribution of EPM parent company and subsidiaries to EBITDA and Group results

Performance in energy

Of the EPM Group's EBITDA of COP 7.9 billion, the Energy Distribution segment contributed 43% with COP 3.4 billion, a decrease of 7%, as revenues grew in lower proportion to costs and expenses, despite having more energy sold at a higher unit cost and an increase in users, as well as an increase in other revenues, including financing services, infrastructure leasing and public lighting. Costs grew 5% above revenues, as a consequence of higher energy costs derived from the behavior of spot prices marked by the El Niño phenomenon, the effect of macroeconomic variables and an increased portfolio impairment.

Power generation accounted for 33% of the Group’s EBITDA, at COP 2.6 billion. Its growth was 30 %, explained by the increase in the average selling price of energy on the stock exchange.

As of the third quarter of the year, EPM Group's total power generation was 13,857 gigawatt- hours (GWh), down 7% compared to the same quarter of 2022. Of this total, the Hidroituango Plant generated 2,576 GWh, accounting for 19% of the business group's generation. In September, river flows were below the historical average, for EPM by 55% and for the National Interconnected System (SIN) by 56%.

Performance in Water and Solid Waste Management

Water Provision, Wastewater Management and Solid Waste Management jointly contributed 18% of the Group’s EBITDA and grew 18% due to increased consumption and tariff indexation, in accordance with current regulations. The EPM Group subsidiaries TICSA and ADASA stand out for their increased construction services provided to third parties associated with related services.

The total costs and expenses of the EPM Group were COP 21.1 billion, growing 19%, mainly explained in the Power Distribution segment by the higher costs of commercial operation due to the purchases of energy at a higher price.

The EPM Group's net result of COP 3.4 billion showed an 11% growth compared to the same period of the previous year, as the lower increase in revenues versus costs and expenses was mitigated by an aggregate net income from exchange difference of COP 131 thousand million, resulting from the revaluations of the Colombian and Mexican currencies by 15.7% and 10.07%, respectively.

EPM Parent Company's Performance

Parent EPM's profit was COP 3.3 billion, 15 % higher than the same period of the previous year, which includes the result of subsidiaries through the equity method for COP 1.4 billion, 10 % higher than the same quarter of the previous year, and the subsidiaries contributed 41 % to the Parent C's profit.

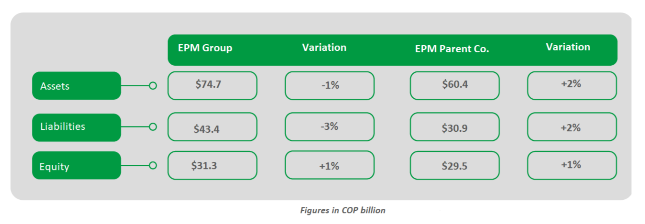

Financial Position of EPM Group and EPM Parent Company

Contribution to development

During the three quarters of the year, the business group's investments amounted to COP 3.3 billion, associated with equipment replacement, expansion and modernization of water, energy and gas networks, maintenance, modernization, and replacement of infrastructure, with the aim of increasing the coverage of services, maintaining, and improving their continuity and quality. 49% of the investments are in the Power Distribution segment, 29% in Power Generation, 20% in Water and the remaining 2% in other projects.

EPM's investments represent 59% of the Group's total investments. Highlights include projects in the Power Distribution segment with the expansion and replacement plans and public lighting, Power Generation with the Hidroituango power plant and the Tepuy Photovoltaic Solar Park.

Domestic subsidiaries account for 27% of investments, Afinia being the most representative with infrastructure and loss control projects. As for the international subsidiaries, they had investments which represent 13%, where ENSA in Panama highlights the program for the reduction of losses and replacement of assets, and ADASA, in Chile, the drinking water projects.

Value generation for stakeholders

As of September 2023, the EPM Group generated added value of COP 12.6 billion, an 11% increase compared to the previous year, which represents greater benefits for its stakeholders.

The following are the most important components of this item: EPM Group People (salaries and benefits) with 15%, Suppliers of goods and services also with 15% (mainly in orders and contracts, insurance, commissions, fees and services), the State, the Community and the Environment together received 15% (with taxes, contributions, fees and environmental costs), Financial Providers 12% (corresponding to financial expenditure and hedging operations to counteract the effect of exchange rate fluctuations) and the District of Medellín 11% for the development programs of the capital of Antioquia, which impact the community’s quality of life.

Financial indicators

Debt/EBITDA ratio: At the EPM Group, this indicator closed at 2.68, compared to 2.87 for the same period the previous year. At the EPM Parent Company, it stood at 3.56, compared to 4.03 at the same date last year.

Financial indebtedness:for EPM Group it was 39%, decreasing 3 percentage points compared to the same period of the previous year, and for EPM parent company it was also 39 %, decreasing 2 percentage points, as a result of the higher capital amortizations that have been made during the year to date.