EPM Groups financial results in 2023 empowers it to continue improving the provision of utility services to more than 44 million people in 6 countries

- Fecha de publicación

- 2024-04-03 00:00

- Contenido

-

• During 2023, EPM Group invested COP 5.2 billion in infrastructure projects

• Net profit in 2023 amounted to COP 3.6 billion

• The District of Medellín perceived dividends for COP 1.7 billion, a contribution to the social development and well-being of the community

EPM Group contributes to the well-being and progress of the territoriesto transform lives. In 2023, the group had a net profit of COP 3.6 billion, as a result of the provision of utility services of energy, gas, solid waste management, water, and sanitation with standards of quality, continuity, coverage, and reliability to nearly 44 million people in Colombia, Chile, El Salvador, Guatemala, Mexico, and Panama.

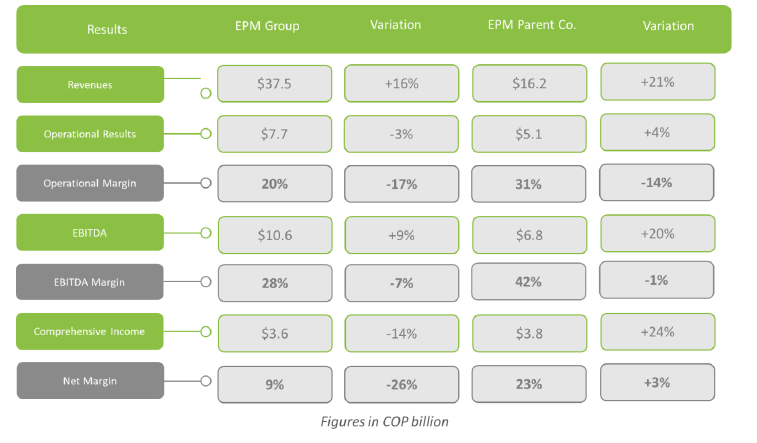

Financial results of the EPM Group and EPM Parent Company in 2023:

As of December 31, 2023, Grupo EPM's consolidated revenues amounted to COP 37.5 billion, with a growth of 16% compared to the same period in 2022, where:

The Energy Distribution and Commercialization Segment contributed 65% of the Group's revenues with COP 26 billion and a growth of 12%, because of higher units sold, increased customers and greater financing services.

The Energy Generation and Commercialization Segment contributed 18% of revenues

with COP 7.3 billion and a growth of 23%, although fewer units were generated, there

was a higher-than-average spot price, due to the use of thermal plants to regulate

reservoirs, caused by the lower availability of water resources because of the effects of the El Niño phenomenon.

The Supply & Commercialization Water, Wastewater Management & Commercialization, and Solid Waste Management & Commercialization segments together accounted for 10% of the Group's revenues, with COP 3.9 billion and a growth of 21%. This because of the indexation of tariffs, according to the regulatory framework, as well as an increase in users. The subsidiaries Aguas de Antofagasta in Chile and TICSA in Mexico had a positive performance, with construction services for third parties standing out.

Consolidated costs and expenses amounted to COP 29.9 billion, with an increase of 23%, mainly explained in the Energy Distribution and Marketing segment by a higher cost of commercial operation due to higher energy purchases at a higher rate. Likewise, non-cash costs and expenses in the Energy Generation and Commercialization Segment were impacted by an increase in provisions.

Regarding EBITDA, in 2023 it amounted to COP 10.6 billion, with an increase of 9%, in turn, the EBITDA margin amounted to 28%.

EPM Group's net income of COP 3.6 billion decreased 14% compared to the same period last year, and with a net margin of 9% compared to 13% in 2022. This situation arose since revenues grew in less proportion to operating costs and expenses, mainly due to a higher purchase price of energy.

The result was also supported, partially, by the accumulated net exchange difference of COP 171 thousand million, because of the revaluations of the currencies of Colombia, Mexico, and Guatemala with 20.54%, 12.62% and 0.32%, respectively, as well as the hedging strategies carried out by the company to contain exchange rate fluctuations.

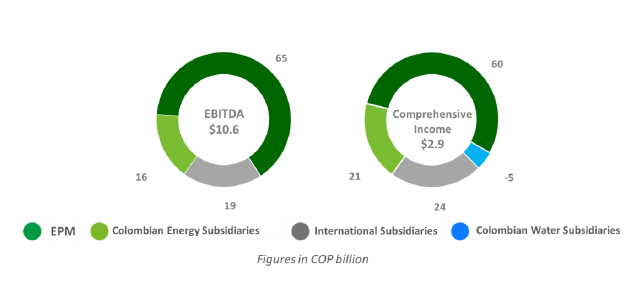

Percentage of contribution of EPM Parent Company and subsidiaries to the Group's EBITDA and results

The percentage of EPM’s results excludes the results of subsidiaries through the equity method. The percentages do not include the Other segment and deletions.

Energy Performance

Of the Group's total EBITDA, the Energy Distribution and Commercialization Segment contributed 41% with COP 4.5 billion, and a decrease of 10% compared to 2022, due to commercial operating costs, due to energy purchases at a higher price, as well as a greater portfolio impairment.

The Energy Generation and Commercialization Segment accounted for 37% of the Group's EBITDA, with COP 4.0 billion. Its growth was 38%, although there was less energy generation, explained by the behavior of the average sales price of energy on the spot market.

In 2023, total power generation in the EPM Group was 19,383 gigawatt-hours (GWh), down 6% from the previous year (mainly caused by the effects of the El Niño phenomenon). The Ituango plant generated 4,461 gigawatt-hours (GWh), equivalent to 23% of the Group's generation, units 3 and 4 started operations on October 28 and 31, 2023, respectively.

Climate variability

From a hydrological point of view, 2023 was impacted by the end of the La Niña phenomenon, between January and April, which led to flows above historical average values, except in February.

From May to December, water supplies were below average, given the effects of the El Niño phenomenon.

On average, the contribution of river´s flows to the reservoirs in the National Interconnected System (SIN) were below the historical average, that of EPM at 83% and that of the SIN at 88%. However, the reservoirs reached high levels at the end of the year due to the strategies of the generation companies to have high volume of reserves in front of the most challenging months under the effects of El Niño phenomenon.

Water and Solid Waste Management Performance

Supply & Commercialization of Water, Management & Commercialization of Wastewater, and Management & Commercialization of Solid Waste together contributed 15% of the Group's EBITDA with COP 1.6 billion and a growth of 8%, due to higher consumption and customers.

EPM Parent Company Performance

EPM Parent company's profit was COP 3.8 billion, 24% higher than the same period last year, which includes the result of the subsidiaries through the equity method for COP 1.6 billion, it means the subsidiaries contributed 41% to the parent company's profit.

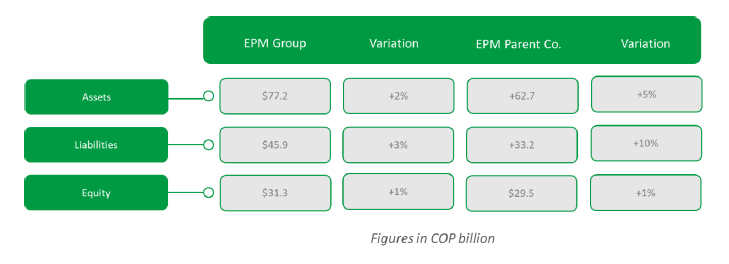

Financial situation of the EPM Group and EPM Parent Co.

Contribution to development

During 2023, the Group invested COP 5.2 billion, 7% higher than the previous year. 46% of the Capex correspond to Energy Distribution and Commercialization Segment, 31% to Energy Generation and Commercialization Segment, 21% to Water and the remaining 2% to other projects.

EPM's capex represent 58% of the Group, with COP 3 billion, where Energy Generation stands out with investments of COP 1.6 billion, mainly the Ituango hydroelectric plant and the Tepuy Photovoltaic Solar Park. Distribution and Commercialization Energy had investments of COP 728 thousand million in plans for the expansion and replacement of infrastructure and public lighting.

Colombian subsidiaries account for 27% of the capex with COP 1.4 billion, Afinia being the most representative with infrastructure and loss control projects. As for the international subsidiaries, their investments represent 14%, with COP 735 thousand million, where Aguas Antofagasta in Chile stands out, with the drinking water projects, and ENSA in Panama, with the loss reduction and asset replacement program.

All these investments add up to the development of the territories, the generation of employment and well-being of the communities.

Generating value for stakeholders

During 2023, EPM Group generated value added of COP 16.3 billion, 3% more compared to the previous year, which represents greater benefits for its stakeholders.

Of this item, the most significant items are: Reinvestment in the Company with 27%, Suppliers of goods and services with 17% (mainly in orders and contracts, insurance, commissions, fees and services), EPM Group Staff with 16% (salaries and benefits), the Government, the Community and the Environment together received 15% (with taxes, environmental contributions, fees and investments), the Financial Suppliers 13% (corresponding to financial expenditure) and the District of Medellin 11%, vital resources for the development of the city and its inhabitants. These figures contribute to the generation of employment and, therefore, to the dynamization of the economy.

Financial Ratios

Debt/EBITDA: in the EPM Group, this ratio closed at 2.62, compared to 2.95 in the previous period. In EPM Parent Co. it stood at 3.32, compared to 3.92 in the previous year.

Financial indebtedness: for both Grupo EPM and EPM Parent Co., it was 39%, down 3% and 1%, respectively, compared to the previous period.

EPM Group continues its commitment to overcome the challenges posed by the environment and communities, such as the continuous improvement in the quality of energy, gas, water and solid waste management services, strengthening the customer experience, reaching more communities with utility services, materializing new solutions in utilities that respond to people´s needs and continuing to be a promoter of development in the territories where the company has presence.

As external auditor, Deloitte & Touche S.A.S. submitted an unqualified opinion on EPM's separate and consolidated financial information.