During the first quarter of 2023, the EPM Group grew 27% in net result compared to the same period of 2022

The EPM Group generated added value to its stakeholders for COP 4.6 billion

- Fecha de publicación

- 2023-05-04 00:00

- Contenido

-

- The EPM Group generated added value to its stakeholders for COP 4.6 billion

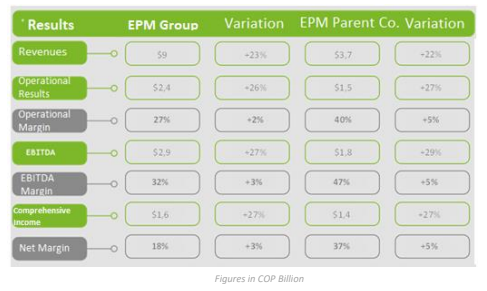

- In the first quarter of 2023, the business group's revenues grew by 23% compared to the first quarter of 2022

- EPM Group's EBITDA was COP 2.9 billion with a growth of 27% compared to the same period of 2022, with a margin of 32%

With a net result of COP 1.6 billion pesos in the first quarter of 2023 and a growth of 27% over the same period of the previous year, The EPM Group makes it possible to continue contributing to the well-being of the communities, through the provision of quality utility services, and to the development programs of the District of Medellín.

EPM Parent Company paid surpluses to the District of Medellín for COP 299 thousand million pesos. These resources are a contribution of EPM to the transformation of the lives of the citizens of Medellin and the city.

First quarter 2023 financial results:

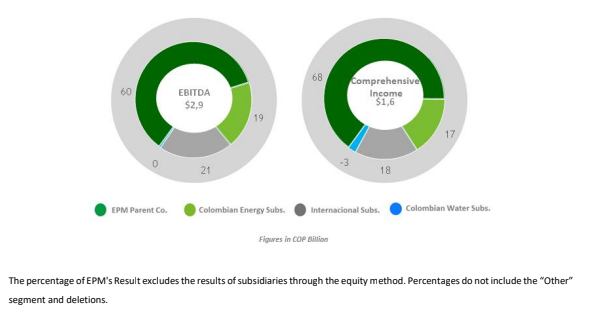

The following is the percentage of contribution of EPM Parent Company and subsidiaries to the EBITDA and results of the EPM Group:

Performance by segments

Of the EBITDA of the EPM Group for COP 2.9 billion, the Energy Distribution segment contributed 43% with COP 1.3 billion. Its 16% growth was due to more energy sold at a higher unit cost and increased revenue from financing utilities. The subsidiary EEGSA, in Guatemala, also stands out, with an increase in customers and more units sold at a higher price.

Power Generation had a weight of 34% in the Group's EBITDA, with COP 1 billion. Its growth was 49%, explained by the increase in electricity generation thanks to the entry into commercial operation of units 1 and 2 of the Hidroituango Power Plant and the greater hydrology, therefore higher energy sales at higher prices, given the increase in the Producer Price Index (PPI). During the period, the total power generation of the EPM Group was 5,025 gigawatt-hours (GWh), with a growth of 14% compared to the same quarter of the previous year, and where 16% was contributed by the two units of the Hidroituango Power Plant.

The segments associated with the Water Business: Water Supply, Wastewater Management and Solid Waste Management, together contributed 16% of the Group's EBITDA and had a growth of 23%, due to increases in customers, consumption, and rates, both in the regulated and non-regulated markets. In the Wastewater Management segment, the subsidiary TICSA stands out for new construction contracts in Mexico and Colombia.

EPM Group's total costs and expenses were COP 6.6 billion, up 22%, below the percentage growth in revenues, explained by commercial operating costs due to higher energy purchases at a higher price due to the effect of macroeconomic variables and growth in staff services due to the effects of the salary increase.

The net result of the EPM Group was COP 1.6 billion, with a growth of 27% compared to the same period of the previous year, impacted by a net income from exchange rate difference of COP 140 thousand million, due to the accumulated revaluation in Colombia of 3.8%; in Chile of 8.04%, in Guatemala of 0.62% and in Mexico of 6.8%, and the hedging strategies established by the Business Group to counteract exchange rate fluctuations.

The Comprehensive Income of EPM Parent Company was COP 1.4 billion, 27% higher than the same quarter of the previous year, which includes the result of the subsidiaries through the equity method for COP 324 thousand million, which means that subsidiaries contributed 24% to the net income of the parent company.

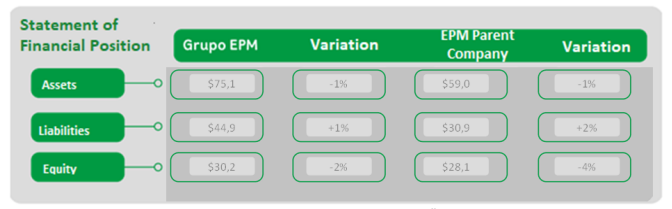

Financial situation of the EPM Group and EPM Parent Company:

Generating value for stakeholders

The EPM Group is an engine of development in the territories in which it operates, with a contribution to the revitalization of the economy, the generation of employment, environmental care, innovation, and the materialization of social initiatives of great benefit to citizens. During the first quarter of 2023 the Business Group generated added value of COP 4.6 billion, 33% more compared to the previous year, which represents greater benefits for its stakeholders.

Of this item, the most significant concepts are People EPM Group (salaries and benefits) and Suppliers of goods and services (development of works and contracts) received 13% each; the State, the Community and the Environment received together 19% (taxes, contributions, fees and environmental costs), the Financial Providers 7% and the District of Medellin 7% (programs of great impact for the citizens of Medellin and the development of the city).

Financial Ratios

Debt/EBITDA: in the EPM Group this indicator closed at 2.71, compared to 3.13 for the same quarter of the previous year. In EPM Parent Company it stood at 3.61, compared to 4.25 for the same period of the previous year.

Financial indebtedness: for the EPM Group it was 40% and for EPM Parent Company it was 39%. The results of the first quarter of 2023 reflect the Organization's commitment to continue contributing to maximizing the value of the EPM Group companies, guaranteeing their sustainability in the current financial scenario for the well-being of all the communities where it has a presence and materializing its higher purpose of contributing to the harmony of life for a better world.